Developer API

Developer API

Teravera Secure API is available for access to developers and partners. To Access the Teravera API, simply complete this form.

API access includes Developer Documentation and Support.

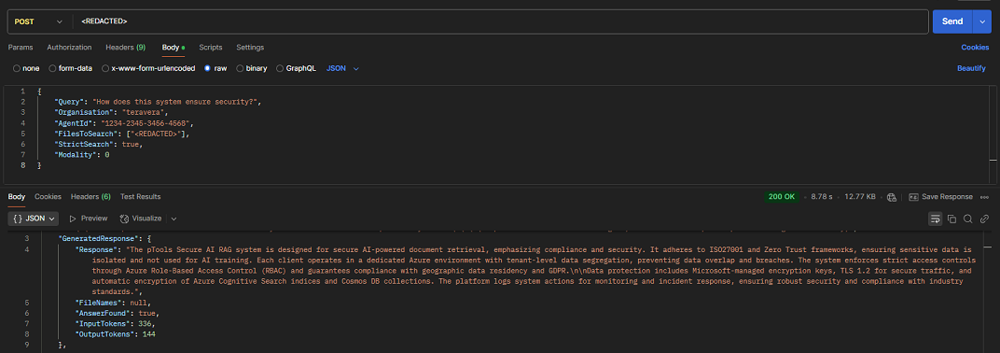

Sample request to Teravera Secure AI headless API via Postman Platform

About

About

Teravera is a Secure API for Secure AI solutions that works at the intersection of AI, Data Integrity and Trust. Teravera is built on a zero-trust security framework and works with OpenAI/Azure, Google/Gemini and AWS/Anthropic. For more about Teravera please contact us here.

Secure AI

Secure AI

Teravera Secure AI and Secure API delivers deep AI capability within a framework that eliminates AI hallucination, protects corporate data and guarantees AI responses within corporate guidelines. Teravera Secure API manages Data Indexing with Multi-module Monitoring and advanced Retrieval Augmented Generation to mitigate Risk in data consumption and AI entropy. For more about Teravera Secure AI and our Whitepaper please fill out the form here.

Teravera AI

Alternative AI

Teravera AI

Secure by default and usage throughout with built-in guide rails from the start.

Alternative AI

Open by default with or without security layer added post deployment.

Teravera AI

Data isolated within client environment, with secure indexing as standard.

Alternative AI

Data is co-mingled across different client solutions.

Teravera AI

Copilot and Teams ready as standard with added secure data management out-of-the-box.

Alternative AI

Plugin and development required.

Teravera AI

Full control of hallucination, elucidation, and entropy of output responses.

Alternative AI

Opaque if any control of hallucination and other response output attributes.

Teravera AI

Full control of AI 'temperature' and related perceived sentience and related misrepresentation.

Alternative AI

Limited or zero control of AI 'temperature' and related perceived sentience and misrepresentation.

Teravera AI

Full 24/7 follow-the-sun enterprise ITIL support capability.

Alternative AI

Read the documentation response and limited if any enterprise support capability.

Teravera AI

Multi-module control and guardrails as standard and easily configurable.

Alternative AI

We don't handle that; you can try configure and customize yourself!

Teravera AI

Complete back-end admin environment with full transparency, reporting, compliance (DORA, GDPR etc.) and ease of use as standard.

Alternative AI

Write your own admin reporting and limited if any compliance.

Agents

Agents

Teravera Secure AI Agents based on Teravera Secure API and developed with our partners include; DORA Queries and Reporting Agent, MiCAR Queries and Reporting Agent, MiFID Queries and Reporting Agent, LEI Issuance Agent, ISIN Issuance Agent, Corporate Actions & Announcements Issuance Agent, Sanctions Screening Agent, Funds Administration Agent. For more information about specific Teravera Agents please contact us here.

Pricing

Pricing

Teravera Secure API for Secure AI is available to developers, partners and distributors. Pricing is tiered to support and usage. Developers gain access at no charge. For more about Teravera Secure API pricing and support please fill out the form here.

Support

Support

Teravera provides multi-level support for Solutions and Agents built by developers, partners and distributors using Teravera Secure API. Support includes standard and enterprise level services based on a follow-the-sun team operating a 24/7 globally.

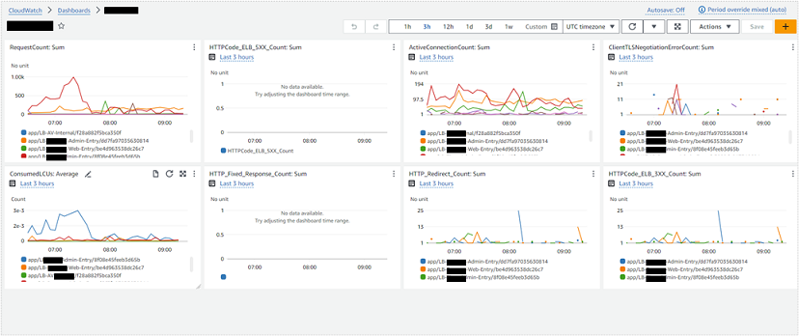

Sample Teravera Secure AI Enterprise Infrastructure Support Dashboard.

Partners

Partners

Teravera Secure API is provided through distribution partners, developers and solution integrators based on turnkey delivery of solutions via the Secure API with full enterprise level support. For more about partners and developers or to enquire about becoming a Teravera partner please fill out the form here.